1. Executive Summary

The Executive Summary is where you explain the general idea behind your company; it’s where you give the reader (most likely an investor, or someone else you need on board) a clear indication of why you’ve sent this Business Plan to them. This is a souped-up “elevator pitch,” a couple of pages that summarizes what your business is all about.

Note that, while the entire Business Plan should be well-written, this section must really demonstrate excellent composition and grammar. This is the first part of your Business Plan that anyone will read, so it’s important that it really “sing.”

The header section of the Executive Summary can benefit from flexible treatment, as well. You can use a company logo, or any other design you’d like, but you want to be sure you include the name of your business, right at the start of the Business Plan.

In the Business Plan section, you will want to get the reader’s attention by letting them know what you do. Try to answer some (or all) of the following questions:

- What products or services do you offer?

- What sector do you operate within?

- Who is your target audience?

- What is the future outlook of the marketplace?

- What makes your offer unique?

- Who’s the boss?

- Why did your company start?

The Executive Summary is the place to succinctly describe your business. It’s also appropriate to address why you’ve created your proposal, answering questions like these, briefly, in addition to those above:

- Do you need investment?

- How much money do you need?

- What is the money to be used for?

- How will your business become profitable?

- What’s in it for the recipient?

The last question is perhaps the most important. Already, only having read as far into your business plan as the Executive Summary, your reader is wondering “what’s in it for me?” And your challenge is to offer them a preview (remember this is a “summary”) of the benefits of accepting your business plan, while not giving away the whole story.

2. Business Description

This next section gives all the must-have details about your business. Here you are looking to answer questions like “when did you start?”; “Why?”; “By whom?”

This is the place for your “origin story.” This section should be just as well-written as the Executive Summary, of course. What is your interest in the market? How’d you get to this point?

As you can tell, the Business Description section amounts to backstory – and that’s essential to any Business Plan.

This is where you tell them where you’re coming from, before you get to “why” you’re in need of an investment, in a nutshell.

3. Mission Statement

The Mission Statement section of your Business Plan expands on some of what you talked about in the Executive Summary.

Here are the major points you will want to make in the Mission Statement.

A) Goals

Explain the end-result you seek from the business venture. Connect it to your customers and readers, in turn.

B) Objectives

Explain the steps you will take to reach your goal. Be specific; demonstrate that you have a good idea of what it will realistically take to achieve your goals.

C) Customers

Your target audience has to be well-defined. Here you need to explain exactly who your customer is. You should define your customer as specifically as possible. Is your customer the 18-24 year old customer base? How about the 18 -24 year old music consumers, as an example? Describe them to the finest level of detail possible.

D) Industry

Why is your niche attractive? Is your industry growing? Will you shake it up with your offer? Are you a disruptor? Explain thoroughly in this section.

E) Strengths

Here you want to outline what makes your company special. Answer why your business is different from the rest of the competition. Who’s on your team? The best tip we’ve got is: investors love a top-notch team.

F) Status of Ownership

Here you want to tell your prospective investors the legal status of your company. Is it a limited liability company (LLC)? Is it a sole proprietorship, or partnership? Whatever the case may be, you’ll want to explain it to your prospect.

4. Products and Services

This section is extremely important to a successful Business Plan. This is where you describe what it is that you have to offer the world.

Be sure to include:

- Detailed descriptions of your Products and/or Services. Feel free to include pictures, as you deem appropriate. Don’t forget to add the pricing and/or fees.

- Next, you’ll want to spend some time extolling the features and benefits of your products and/or services. Break it down. Remember that customers love benefits, and prospective investors want to know that you understand those benefits.

The Products/Services you offer are the core of your business. You really can’t afford to omit anything relevant here. Your prospective investor will surely want to know what you have to offer, and they’ll want to know enough about those things to be able to believe in them.

5. Marketing Plan

The Marketing Plan is one of the most essential parts of your Business Plan; marketing is the thing that brings your business to its audience.

The first thing to do in the Marketing Plan section is to prove that you know your target audience. Put the research, market analyses, and industry knowledge that you possess to work in this section. You are illustrating to your recipient that you know your audience better than anyone, and that makes yours the ideal business to serve the audience.

This section can be broken into six distinct parts, as follows:

- Clearly define and explain your target audience

- Briefly describe your competition – particularly what makes you better at what you do than them

- Detail your niche. What particular area of your industry to you fit? Where do you squeeze in, in light of the innovation?

- List your distribution channels.

- Describe how you will promote the business. What media outlets will you use for advertisement? How much is your marketing budget? Your prospective investor will surely want to know.

- State your image or message. How will you present your business to the public? Tell your reader how your customers will see your business.

The Marketing Plan is essential. Make sure you give it plenty of attention, in your Business Plan.

6. Operations Plan

This section of your Business Plan should detail your day-to-day operation. This is important; your prospective investors want to know that you’ve given some thought to the daily operation of your business.

Here, you’ll want to describe the various resources, personnel, and real estate involved in the execution of your business activities.

Here are some of the things you will want to include in the Operations Plan section:

Location-- for either service or product, where do you work out of? (Be specific, with dimensions, cost of utilities etc.)

Transportation-- how do you get your product to your clients? third-party store? Legal requirements -- Do you need permits? licenses? etc.

What are the regulations you follow? Work with unions? etc.

Personnel-- Describe the type of positions you already have, plus what you may need to expand on.

Inventory-- Do you keep things in stock? Where? How much does that cost? What is the value of it? Providers/Suppliers -- Who do you lease work out to? List names, addresses, websites.

Timing for Accounts Receivable/Accounts Payable-- Investors want to know about anything that could keep them from making a quick profit.

7. Management Organization

In this section, detail the management structure inside your organization. Your prospective investors will be keen to know who’s calling the shots and to whom at your business.

Here are the things you will want to make sure you list here:

- Board of Directors

- Advisors

- Accountants

- Lawyers

- Consultants

- Staff

Remember, you don’t have to list everyone, down to the janitors, but you do want to be thorough in this section. Let your prospect know that you’re not just winging it, and that you have a team in place.

8. Financial Plan

The Financial Plan is one of the most important, if not the absolute most important, parts of your Business Plan. This is a section that your reader will be eyeing closely, and they will expect you to have put a lot of love into this one, too.

Begin this section by telling the prospective investor about the funding you’ve received so far. Where has it come from? How much does it total? Be forthcoming about your capital and its sources, first and foremost.

This section is also the place where you plan your Profit and Loss (P&L) for at least the next 12 months. This spreadsheet can be used in connection to the cash flow spreadsheet. If your business plans to run a loss for the first year (or two, or three), you should clarify this point in this section, and add a model profitable year for good measure. Just be sure to explain that your Business Plan doesn’t always project a loss.

Cash Flow Spreadsheet Example

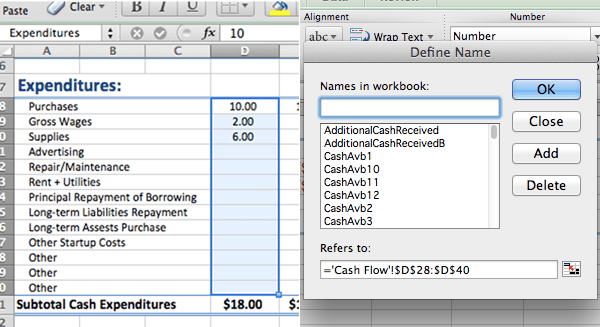

Cell and Section Names:

CashReceivedB, Expenditures, etc are the names of the sections. To name the cell of section of cells - highlight it and then rename in the upper left corner.

Changing the name afterwards, if misspelled or deleting it completely, if reverting back to original cell name is done through “Insert -> Name -> Define”.

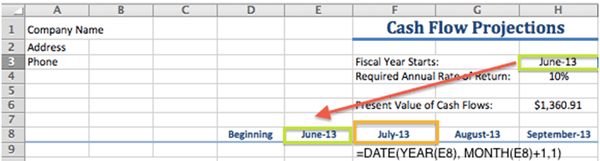

Fiscal Year and PV of Cash Flows

Dates will be change automatically if the date in the “Fiscal Year Begins” is changed.

Another section where investors would look is the present value of cash flows. It’s the sum of all cash flows discounted back 1 period using company’s annual rate of return, which is set by the company. A number was made up.

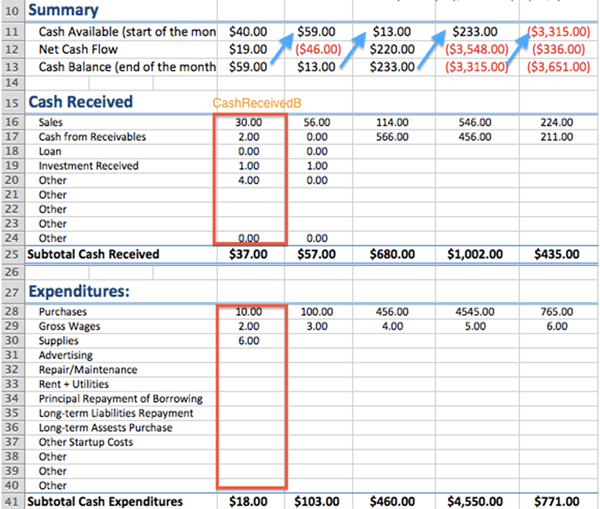

Cash Received, Expenditures, Net Cash Flow

Cash Received is a section where someone would record all the cash inflow from different activities like operating or financial. Cash outflows are recorded in Expenditures. Both of these sections are summed in the subtotals: (=SUBTOTAL(109,CashReceivedB)). 109 – specifies the function that should be done by the subtotal, other could be used too, such as averaging; there are numbers from 1 to 11.

With these two sections it is easy to find: Net Cash Flow = Cash inflow – Cash outflow.

I also added two sections, which show how much money was in the beginning of the month, and how much is available at the end. That cash balance from previous month is transferred to the next month Cash Available section.

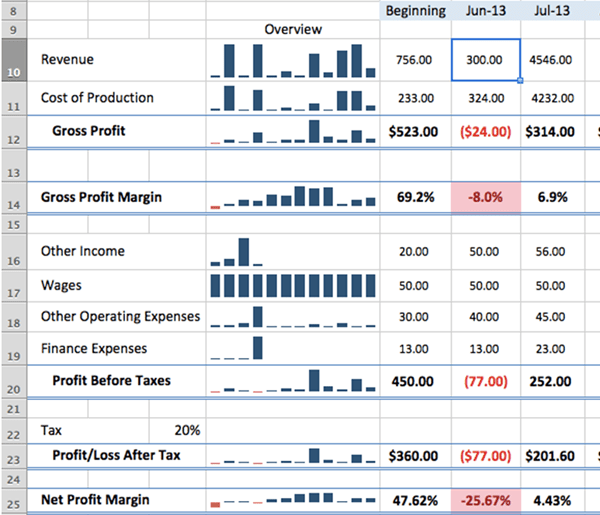

Profit/Loss Analysis Spreadsheet Example

Formulas for this spreadsheet:

- Gross Profit = Revenue – Cost of production

- GP Margin = Gross Profit / Revenue

- Profit before taxes = Gross Profit + Other Income – Other Expenses

- Profit loss after tax = Profit before tax * (1 – Tax Rate) *However if loss was incurred, tax won’t be applied. To accommodate for that write the IF statement: if Profit Before Taxes > 0, then apply the formula above to that number, otherwise the negative number will be transferred to this cell.

- Net profit margin = Profit after tax / Revenue

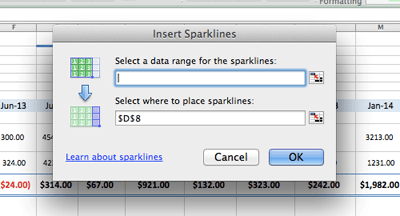

Sparklines:

Overview is done with Sparklines. Select the cell where you would want to see the graph then Insert -> Sparklines. The window will pop up where you can choose the data to be shown.

To customize the graph, click on one of them and the ribbon will show up, where you can choose different styles of presentation.

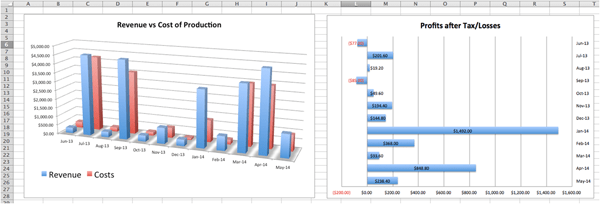

Graphs for Profit/Loss Analysis Example

Creating a chart:

Go to Insert -> Charts, highlight the data you are trying to present. Charts ribbon has variety of options that will help you improve the look and style of graphs.

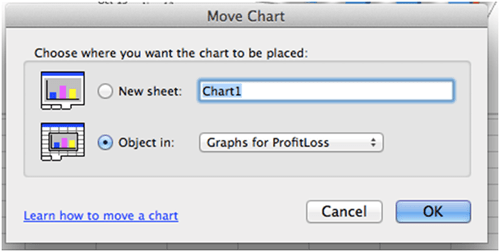

Transferring chart to another spreadsheet

In order to move the chart to a new or existing sheet, press control or right click on it and choose “Move”:

Since the charts reference the same cells in the profit/loss analysis spreadsheet, updates in that table will automatically be reflected on the graph.

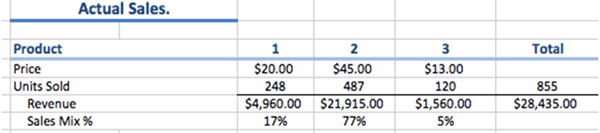

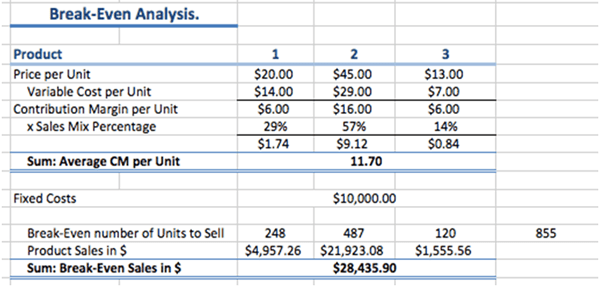

Break-Even Analysis Spreadsheet

Finding Sales Mix %:

In this part, the goal is to find current products sales mix, which will be used in the analysis. You need to input the price and number of units sold/services provided. Sales mix % is then found for each product. These numbers should be transferred by hand to the second table.

Break-Even Analysis:

Formulas:

- Contribution Margin Per Unit = Price per Unit – Variable Cost Per Unit

- Average CM per Unit = CM per Product 1 * Sales Mix % Product 1 + CM per Product 2 * Sales Mix % Product 2+ ...

- Break-Even number of Units to Sell = Fixed Costs / Average CM per Unit. *This is the total number of all products, to find how many units of each product you need to sell:

- B-E units of Product 1 = (Fixed Cost / Average CM per Unit) * Sales Mix of Product 1

- Product Sales in $ = B-E units of Product 1 * Price

This table is useful to quickly assess how different scenarios would affect the break-even points. You can copy the analysis table and paste it right next to each other for easier comparison.

9. Conclusion/Call to Action

The last part of your Business Plan is a conclusion, which ideally should contain a call to action (CTA). Your CTA here is a bit different from a CTA on something like a Web-based landing page. A Business Plan CTA simply clarifies the next step. Is it a phone call or a meeting? Perhaps it’s a phone call to schedule a meeting. Whatever your CTA may be, you’ll want to make it clear, in this section.

10. Confidentiality Statement

Your Business Plan is top secret, right? If that’s the case, it’s up to you to make sure that’s clearly stated to those who receive the Business Plan. One way to protect your business and its intellectual property (IP), is to include a confidentiality, or nondisclosure (NDA) statement in your Business Plan.

11. Addendums

Here is where you add extra information, including but not limited to:

- -- less interesting information, that someone might like to know (positive, of course)

- -- graphs, technical drawings, etc

- -- citations: sometimes you may include a statistic in your proposal, about your industry, your competitive market, etc., but you must cite it.

- -- business studies

- -- city plans, office plans

- -- list of assets for collateral; financial backgrounds of key investors

- -- CVs/resumes, credentials of key players

- -- key collaborators, etc

[Sender.Company]

Signature

MM / DD / YYYY

[Client.Company]

Signature

MM / DD / YYYY